QuickVal: Back of the envelope for a digital world

Become a beta partner with redIQ on our latest underwriting solution

redIQ has released a plethora of new product features and updates throughout this year, including preset assumptions, commercial units functionality, and, most recently, QuickSync, our exciting new multifamily underwriting option for redIQ clients who prefer their model over our own. Today marks another exciting moment with the release of QuickVal, a beta feature that brings back-of-the-envelope valuation into the 21st century.

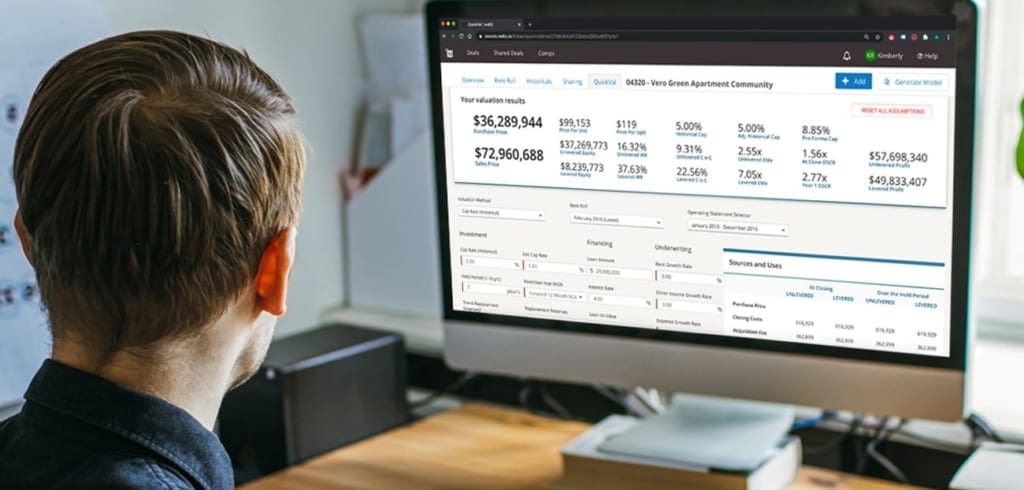

QuickVal empowers users to perform a lightning-fast initial screening of a deal based on data extracted from rent rolls and operating statements, along with a user’s assumptions, such as cap-rate sensitivity, income growth rate, vacancy rate, and more. QuickVal offers multiple valuation methods, allowing for a clear look into a property’s potential worth. After these inputs, QuickVal takes over and provides an initial, but robust, underwriting of a property, allowing a user to make a quick decision as to whether or not the deal warrants a more comprehensive review.

For investors, this means getting an idea of how a property aligns with expected returns and overall investment strategy. For brokers, it accelerates the process of creating a narrative around a property — and allows them to form initial Broker Opinions of Value without leaving the redIQ app.

QuickVal doesn’t replace back-of-the-envelope underwriting. It revolutionizes it, bringing the speed, power, and accuracy that give our clients a competitive edge. Whether an investor needs to find a diamond in the rough or a broker wants to instantly analyze a property while on the phone with a client, the moment they receive financials, QuickVal provides a solution.

Beta access to QuickVal runs through the end of the year and allows clients to participate directly in the app’s development. If you are already a redIQ client, log in to your account, access a deal, and click QuickVal at the top of the menu bar. If you aren’t, provide your contact information below, and we’ll have someone reach out to discuss redIQ and QuickVal.

Request A Demo

See QuickVal in action and learn how redIQ can transform the way you analyze and underwrite multifamily transactions.

About redIQ

Since 2012, redIQ has led in the multifamily analytics and underwriting software space. Six of the top ten acquisitions teams and eight of the top ten brokerages rely on redIQ daily, and more than 30% of all multifamily transactions pass through the platform each year. Our platform allows CRE professionals to extract and standardize data from rent rolls and operating statements instantaneously, gain deep insights into every property, and generate a comprehensive underwriting, whether with our model or their own. Our robust set of features includes floor plan summaries, cash flow analysis, data-driven, hyperlocal comp sets, easy deal sharing, preset assumptions underwriting templates, and more. redIQ will always provide our users with better insights and faster underwriting, empowering them to make smarter investment decisions.