QuickVal Has Become FirstPass: New Name, Same Speed and Efficiency

Let FirstPass Help You Decide

redIQ users have the simplest workflow in the multifamily industry. First, they standardize deal financials in dataIQ, our online platform. From there, they use that standardized information to populate our model, valuationIQ, or use our Excel plugin, QuickSync, to populate their own.

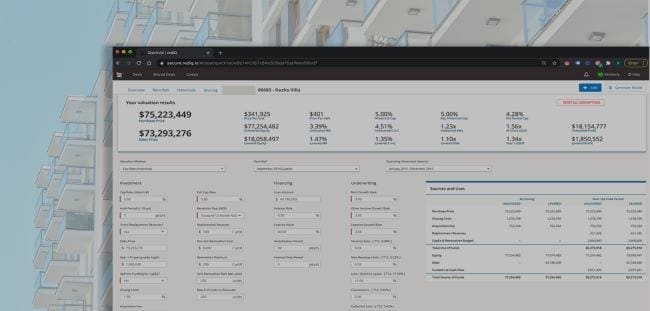

However, as every multifamily professional knows, not every deal deserves a full underwriting, no matter how simple the process might be. Last year, redIQ released an exciting new feature to our platform, QuickVal. With its release came careful consideration of how to best portray the value this feature provides and in doing so, we’ve landed on a new name: FirstPass.

The reasoning? Well, this simple yet powerful back-of-the-envelope analysis allows you to quickly assess a property’s value at first glance. FirstPass takes standardized rent rolls and financial statements along with user-input assumptions and delivers an accurate assessment of a property’s value. It’s the perfect way to perform initial screens on more assets in order to identify those worth a full underwriting, and the best way to spend less time on dud deals. It all takes place right within the redIQ platform, using data already synced to the deal.

Sound like FirstPass could work for you? Sign up for a demo to see redIQ and the feature in action below.

Request A Demo

To see these features and the rest of the redIQ platform in action, schedule a demo today.

About redIQ

Since 2012, redIQ has led in the multifamily analytics and underwriting software space. Six of the top ten acquisitions teams and eight of the top ten brokerages rely on redIQ daily, and more than 30% of all multifamily transactions pass through the platform each year. Our platform allows CRE professionals to extract and standardize data from rent rolls and operating statements instantaneously, gain deep insights into every property, and generate a comprehensive underwriting, whether with our model or their own. Our robust set of features includes floor plan summaries, cash flow analysis, data-driven, hyperlocal comp sets, easy deal sharing, preset assumptions underwriting templates, and more. redIQ will always provide our users with better insights and faster underwriting, empowering them to make smarter investment decisions.