New Feature Highlight: Bridge Loan and Future Value Refinance Sizers

valuationIQ Enhancement: Bridge Loan and Future Value Refinance Sizers

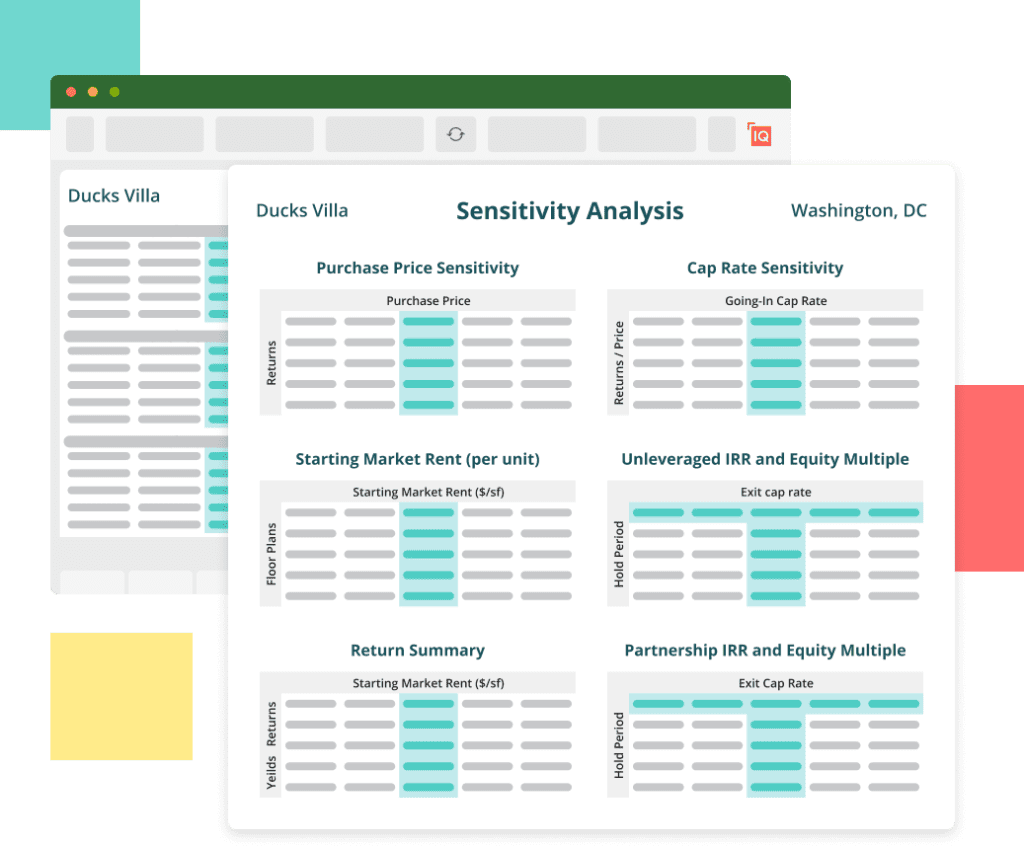

In the current economic environment, debt is cheaper than equity, making the financing of both acquisitions and subsequent capital expenditures appealing. The latest updates to valuationIQ, our proprietary underwriting model, add functionality designed for teams who have adapted their capital structures in response to this reality.

The new Bridge Loan and Future Value Refinance Sizers, built in close consultation with a number of clients, add the ability to size bridge loans, adjust loan draws to fund future capital expenditures, and the ability to model a future refinancing based on the projected value of an asset at the end of a bridge loan term. Many redIQ clients invest for the long term, and the release of these capabilities simultaneously means valuationIQ allows users to model the full hold period. In addition, redIQ has updated labeling and guidance within valuationIQ, replacing ambiguous labels like “Loan 1” and “Loan 2” with “Bridge” and “Refinance” when applicable.

Keep your eyes on your inbox: redIQ will continue to release new functionality in response to changing market conditions and client requests.

Request A Demo

Transform the analysis and underwriting of your multifamily properties.