Market Context, Delivered: Radix Research Now in redIQ

Radix Research: Now Live in redIQ

Building a multifamily investment thesis means going beyond underwriting. It requires context and a deep understanding of market dynamics and economic trends.

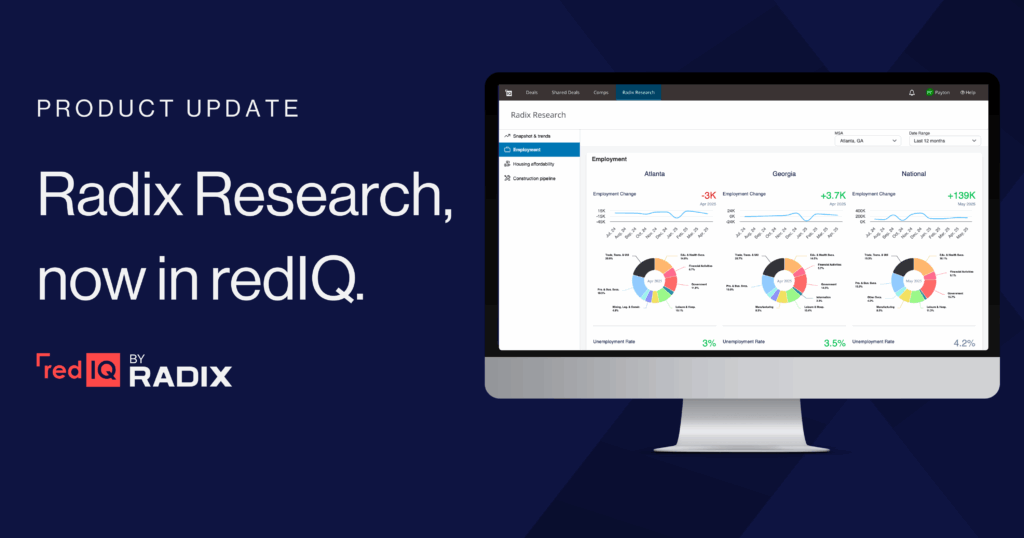

Today, we’re excited to announce a powerful new integration that makes accessing that context easier than ever: Radix Research is now live in redIQ.

The missing piece in evaluating an investment

Until now, redIQ users have relied on internal financials, rent rolls, and T-12s to assess properties. These critical inputs help determine the health and value of a given property, but do not provide information about the surrounding market. Without understanding the broader dynamics at play, it’s easy to misjudge risk or miss an opportunity.

Sourcing this market context often meant bouncing between tools, collecting fragmented data, and relying on static market reports that quickly become outdated. Now, with Radix Research integrated directly into redIQ, you can access the market data you need right where you need it, right alongside your analysis and underwriting workflow.

The integration brings four core reports into redIQ, delivering critical insights to complement your underwriting:

- Snapshots & Trends: Provides a quick pulse on market performance by comparing your selected MSA or submarket to state and national benchmarks. Metrics such as net effective rent, concessions, occupancy and leased percentage, and weekly traffic and lease activity are sourced from Radix Analytics.

- Employment Report: Track job growth and labor market trends in your target metro, state, and nationwide. See breakdowns of employment by industry at all levels, all sourced from Bureau of Labor Statistics data. Let this information guide your understanding of the economic stability of a target market.

- Housing Affordability Report: Evaluate the relationship between wages and rents. This report helps you identify rent burden levels across renter segments and assess the sustainability of current rent growth. This data comes directly from Freddie Mac and Radian.

- Construction Pipeline Report: See what’s coming to market, with data from BuildCentral. Monitor upcoming multifamily deliveries, including unit counts and projected timelines, so you can factor future supply, and potential competition, into your investment strategy.

Radix Research use cases for multifamily professionals

Radix Research gives acquisition teams the market intelligence needed to evaluate investments with a wider lens. Instead of relying solely on asset-specific details, teams can factor in external forces like new supply pipelines that could pressure future performance. By incorporating real-time data on occupancy across a market, users can more confidently model revenue assumptions based on what’s actually happening in the field. The platform also offers employment trend insights, allowing teams to spot markets with stronger job growth (and, by extension, stronger rental demand) for more informed investment decisions.

How this update benefits you:

- Get time back: No more toggling between platforms or tracking down reports to supplement your underwriting—everything is embedded in your workflow

- Make better decisions: Evaluate properties in the full context of market conditions

- Increase consistency: Use a standardized set of data across your team and portfolio to build a cohesive thesis about assets and markets

- Trust the data: Stop relying on outdated, PDF research reports – get data that updates automatically, directly from Radix Research

Radix Research: Available to redIQ users now

If you’re a redIQ user, you can access Radix Research now in redIQ. If your firm doesn’t use redIQ, contact our team to get started and elevate your analysis, underwriting, and research process.

With this launch, Radix continues to deliver on the promises we made during the redIQ acquisition to bring more value to end users. With it, we’re also bringing the industry one step closer to an integrated, end-to-end underwriting ecosystem. Welcome to the future of multifamily analysis.