Sign up below to receive the latest insights into the multifamily market from redIQ. We swear, we won't blow up your inbox.

Developing Strategies in Opportunity Zone Investing

Renewed Enthusiasm for Opportunity Zone Investing

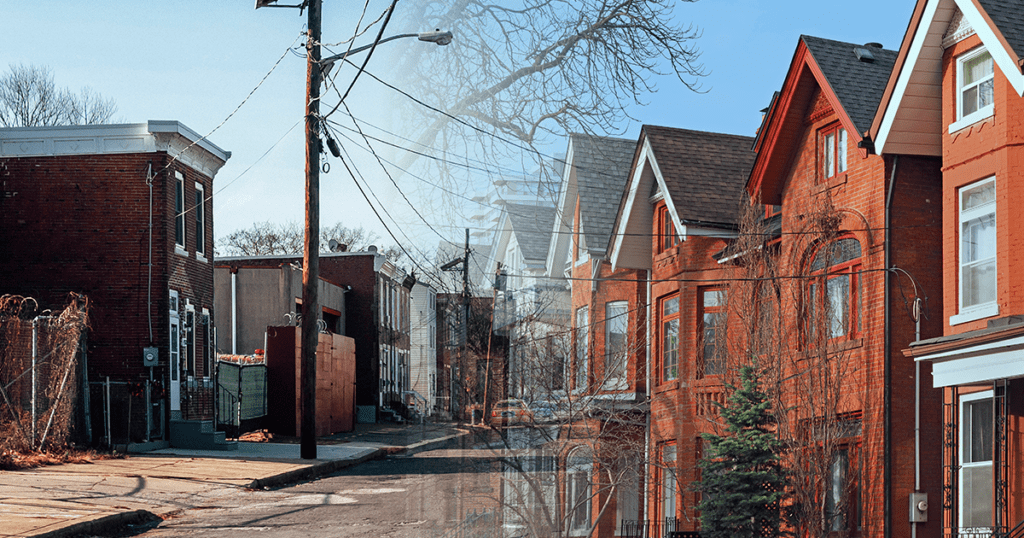

The federal Opportunity Zones program has proven popular with investors of all kinds, directing money into designated neglected urban, suburban, and rural areas with the promise of substantial tax credits and other incentives. While Opportunity Zones were designed to reward investors of any kind, they have proven particularly useful for real estate companies and funds, as most benefits kick in only after ten years in operation within a given zone.

Critics were originally skeptical that tax credits would incentivize the quick creation of new funds to invest in areas that most need new jobs, infrastructure, and housing. Initial excitement over potential breaks on capital gains tax of 10% to 15% gave way to confusion due to slow action on the government’s part to release solidified plans.

Iterations to the initial plans have meant a return of enthusiasm and activity by multifamily investors. Originally limited mostly to ground-up developers, new provisions mean better incentives for those interested in rehabilitating existing housing stock. Interest has expanded from traditional real estate investors, such as CRE private equity company Virtua Partners, to newcomers to the multifamily world, such as Anthony Scaramucci’s SkyBridge Capital.

Strategy Highlight: Origin Investments

Opportunity Zones are intended to provide aid for areas in need of capital infusions, but with some 8,700 such zones spread across the country, their economic statuses vary widely. Origin Investments, a longstanding multifamily real estate investor based in Chicago, saw overlap between their existing value-add strategy and the prospects provided by Opportunity Zones. Origin invests in neighborhoods that are in what co-founder Michael Episcope refers to as “the path of growth.” These are mostly urban or urban-adjacent neighborhoods already undergoing gentrification. The creation of infill like the kind that Origin will build is already happening, but construction will accelerate, maybe even to a frenzied pace as more investors take advantage of the tax credits put in place.

Origin intends to deploy capital raised as part of a new Qualified Opportunity Zone (QOZ) fund in a way that differs from other, similar funds. Rather than targeting a diverse smattering of zones across the country, most of the money raised will target neighborhoods and cities where Origin already has a grasp of what works—those already on the “path of growth.” These include multifamily hotspot Charlotte, a city with a vibrant restaurant scene and increasingly diverse economy, and western boomtown Denver. Origin has already closed or is approaching closing on sites in these cities, meaning investors are not blind going in—they have an understanding of where assets will be and what they will look like upon completion, which is not the case for most similar funds. This marriage of geographical expertise and hefty tax credits will no doubt pay off for Origin and their investors.

Moving Forward

Some have expressed anxiety that areas already experiencing gentrification and growth will exclusively receive the bulk of the new money directed by QOZ funds, as these areas represent the best chance for investors to preserve and grow their capital. Investors and real estate experts have dismissed this concern as a product of time. A first wave of investors in relatively developed Opportunity Zones will be followed by a second wave of investors more willing to stomach risk.

There is some evidence the second wave is already beginning. Another Chicago-based fund, Decennial Group, intends to focus on a geographically diverse set of zones in Indiana, Missouri, and Alabama. Nevertheless, whether other companies will join Decennial and create a meaningful second wave remains up for debate. That said, the Department of Housing and Urban Development recently announced an expansion of their low-income housing tax credit financing program to include Opportunity Zones. This change should channel some of that capital to these underserved areas on an accelerated schedule. The program continues to evolve, and it is likely that as time goes on local authorities will add their own tax credits and other incentives to further stimulate growth.